Goods and Services Tax (GST) is one of the most significant tax reforms in the history of India. Introduced to simplify the indirect tax system, GST replaced a complex web of central and state taxes with a unified structure.

This guide explains GST in India from the ground up, its constitutional foundation, how it is structured, and the key features that define how it works today, using simple, easy-to-understand language.

What Is GST?

GST (Goods and Services Tax) is a comprehensive indirect tax levied on the supply of goods and services in India.

Instead of multiple taxes, such as:

- Excise Duty

- Service Tax

- VAT (Value Added Tax)

- Entry Tax

- Luxury Tax

GST brings most indirect taxes under one system.

In simple terms:

GST is a tax on consumption, paid by the final consumer, but collected at every stage of the supply chain.

Why Was GST Introduced in India?

Before GST, India had a fragmented tax structure. The same product could be taxed multiple times by different authorities, leading to:

- Cascading of taxes (tax on tax)

- Higher prices

- Complex compliance

GST was introduced to:

- Create a single national market

- Eliminate the cascading effect

- Make taxation transparent

- Improve ease of doing business

Constitutional Framework of GST in India

GST required major changes to the Constitution because taxation powers were earlier divided strictly between the Centre and the States.

These changes were brought through the Constitution (One Hundred and First Amendment) Act, 2016.

(a) Article 246A – Special Power to Levy GST

Article 246A gives simultaneous power to Parliament and State Legislatures to make laws on GST.

This means:

- Both Centre and States can levy GST

- For inter-state supplies, Parliament has exclusive power

This article is the constitutional backbone of GST.

(b) Article 269A – GST on Inter-State Supplies

Article 269A provides that:

- GST on inter-state trade is called IGST (Integrated GST)

- IGST is levied and collected by the Centre

- Revenue is later shared between Centre and States

(c) Article 279A – GST Council

Article 279A establishes the GST Council, a constitutional body that makes recommendations on:

- GST rates

- Exemptions

- Threshold limits

- Model laws

The Council includes:

- Union Finance Minister (Chairperson)

- Union Minister of State for Finance

- Finance Ministers of all States

The GST Council promotes co-operative federalism, where Centre and States work together.

(d) Compensation to States

The Constitution amendment also provided for compensation to States for revenue loss arising due to GST for a specified transition period.

Structure of GST in India

India follows a dual GST model, meaning two authorities levy tax on the same transaction.

(a) CGST – Central Goods and Services Tax

Collected by the Central Government.

(b) SGST – State Goods and Services Tax

Collected by the State Government.

(c) IGST – Integrated Goods and Services Tax

Collected by the Central Government on inter-state supplies and imports.

Example

If a product is sold within a state:

- CGST + SGST apply

If a product is sold from one state to another:

- IGST applies

Destination-Based Consumption Tax

GST is a destination-based tax.

This means:

- Tax revenue goes to the state where goods or services are consumed, not where they are produced.

Example:

If goods are manufactured in Maharashtra but consumed in Karnataka, Karnataka gets the GST revenue.

GST as a Value Added Tax

GST is a form of value added tax.

Tax is charged only on the value added at each stage, not on the entire transaction value repeatedly.

This is achieved through Input Tax Credit (ITC).

Input Tax Credit (ITC)

Input Tax Credit allows a business to:

- Reduce the tax it has already paid on purchases

- From the tax it has to pay on sales

Example

- Tax paid on raw material = ₹1,000

- GST collected on sale = ₹1,500

Payable GST = ₹500 (₹1,500 – ₹1,000)

ITC removes the cascading effect and lowers costs.

Key Features of GST in India

(a) One Nation, One Tax (In Spirit)

Although multiple components exist, GST creates a unified market.

(b) Uniform Law Structure

CGST Act, SGST Acts, IGST Act, and UTGST Act follow a common framework across India.

(c) Technology-Driven System

GST is administered through an online portal:

- Registration

- Returns

- Payments

- Refunds

All are largely electronic.

(d) Multiple Tax Slabs

India follows a multi-rate structure, broadly:

- 0%

- 5%

- 12%

- 18%

- 28%

Certain items may attract additional cess.

(e) Threshold Exemption

Small businesses below the prescribed turnover limits are exempt from mandatory registration.

(f) Composition Scheme

Small taxpayers can opt for a simplified scheme with:

- Lower tax rate

- Limited compliance

- No ITC benefit

How GST Replaced Earlier Indirect Taxes

GST subsumed many central and state taxes such as:

Central Taxes

- Central Excise Duty

- Service Tax

- Additional Customs Duties

State Taxes

- VAT

- Entry Tax

- Entertainment Tax (except local body)

- Luxury Tax

This consolidation simplified the system.

Important Judicial Developments on GST

Courts have clarified several constitutional aspects of GST, including:

- Validity of GST laws

- Nature of GST Council recommendations

- Scope of Input Tax Credit

Judicial scrutiny ensures GST functions within constitutional boundaries.

Current Status and Ongoing Evolution

GST is not static. It continues to evolve through:

- Rate rationalisation

- Simplification of return filing

- Clarifications through notifications and circulars

- Council recommendations

The objective remains to balance revenue needs with ease of compliance.

Why GST Matters for India

GST has:

- Improved tax compliance

- Increased formalisation of economy

- Reduced logistics costs

- Encouraged interstate trade

While challenges remain, GST has fundamentally transformed India’s indirect tax landscape.

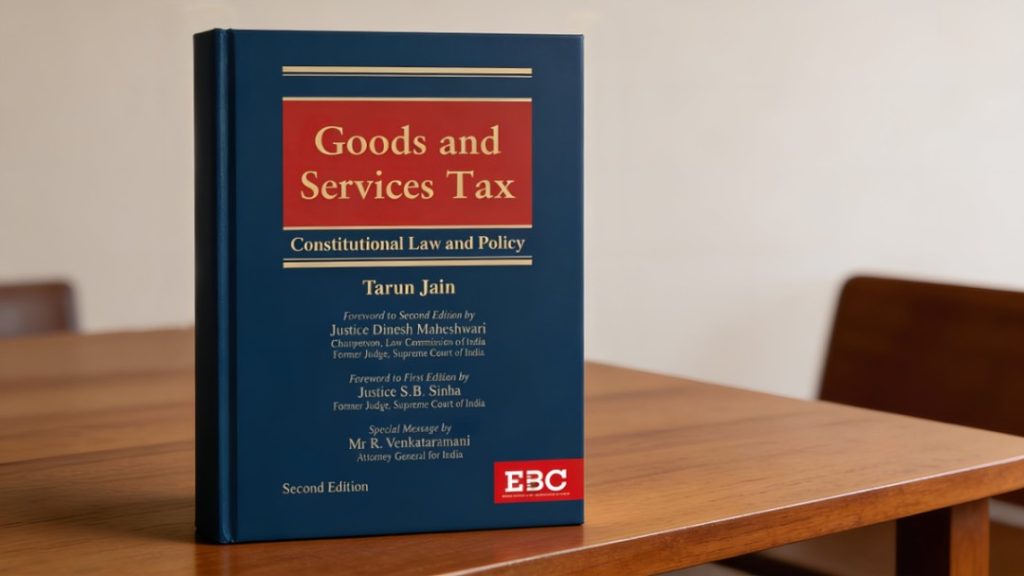

For a more detailed understanding of this subject, you may refer to this book.