What Is the Income Tax Act, 2025?

- The Income Tax Act, 2025 replaces the decades‑old Income Tax Act of 1961.

- It received Presidential assent on 21 August 2025, and is set to come into force from 1 April 2026 (unless specified otherwise).

Key Changes & Features

1. Simplification and Structural Reforms

- The new law reduces the number of sections from 819 in the 1961 Act to 536 sections under 23 chapters.

- It also simplifies language, removes redundant provisions, and arranges laws in a more coherent, reader‑friendly manner.

2. Tax Year Concept

- A major change is replacing the old “Assessment Year” (AY) and “Previous Year” system with a unified “Tax Year” concept. This aims to align the income‑earning period and tax assessment period into one.

3. Slabs, Exemptions, and Rebate

- Under the new tax regime, income up to ₹4,00,000 will be taxable at 0%. Thereafter, slabs gradually move up to 30% for income above ₹2,40,00,000.

- There is also a raised standard deduction (for salaried individuals) and enhanced rebate under Section 87A so that many taxpayers with income up to ₹12 lakh may have no tax liability under the new regime.

4. Virtual Digital Assets (VDAs) & Clarity for Modern Transactions

- The Act officially includes definitions for Virtual Digital Assets (cryptocurrencies, NFTs etc.) and classifies them for tax purposes.

- It also strengthens rules around TDS/TCS, clarifies reporting obligations, and aims for digital‑first tax administration.

5. Transitional Provisions

- While the Act is new, transitional rules ensure that pending appeals, assessments, accumulated losses etc under the 1961 Act are respected and carried forward where applicable.

What It Means for You

- If you’re a middle‑income earner, the raised exemption and revised slabs under the new tax regime mean potential savings.

- For businesses and professionals, easier compliance, reduced ambiguity, clearer language, and less discretion for tax officers may reduce litigation and compliance costs.

- If you deal with digital assets, or get income via non‑traditional sources (like VDAs, foreign income), the new law provides clearer rules.

- Everyone will need to adapt to the “Tax Year” terminology, updated tax forms, and digital processes.

Accessing the Act & Researching Further

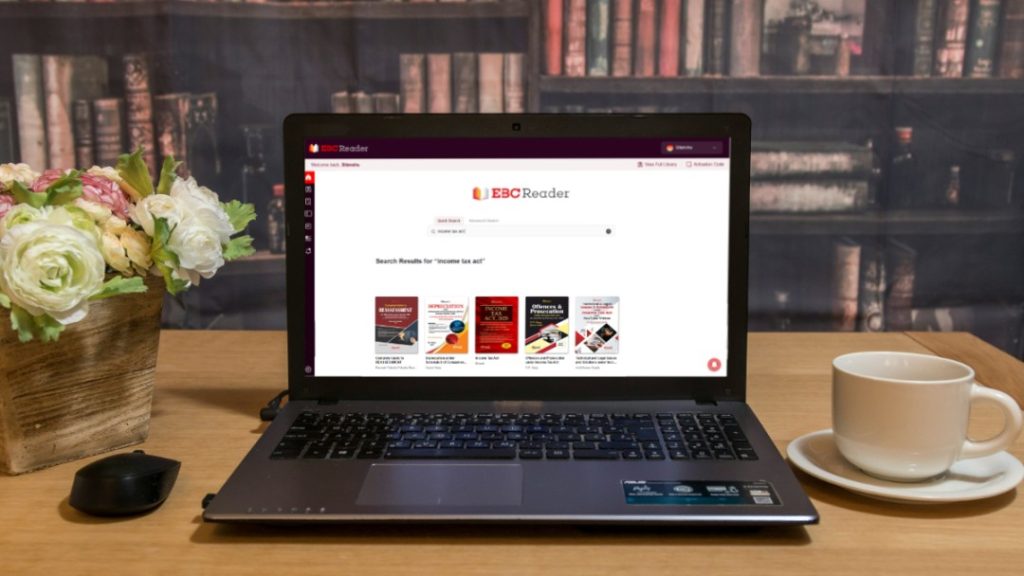

- The Income Tax Act, 2025 along with detailed commentaries is available on EBC Reader, EBC’s comprehensive digital legal platform.

- The platform features a new interactive dashboard that significantly enhances the legal reading and research experience.

- The AI-powered recommendation system suggests related books, commentaries, and journal articles based on your reading preferences and history.

- While studying the Income Tax Act, 2025, this feature helps you explore connected content like expert analysis, relevant case law, and comparative texts.

- Whether you are a student or a professional, the dashboard makes navigating complex tax reforms easier and more efficient.

Learn more about this Act by clicking here.