Succession and inheritance laws in India determine who gets a person’s property after death and in what manner. These laws affect everyone, families, property owners, business owners, and legal heirs, and are among the most important areas of personal law.

This guide explains the subject from basic concepts to advanced legal principles, using clear, accurate, and easy-to-understand language.

1. What Is Succession?

Succession means the legal process by which a deceased person’s property, rights, and obligations pass to living persons (heirs or beneficiaries).

It includes:

- Movable property (money, shares, vehicles, jewellery)

- Immovable property (land, house, flat)

- Intangible property (intellectual property, digital assets)

2. What Is Inheritance?

Inheritance refers to the actual right to receive property from a deceased person under succession law.

Succession = process

Inheritance = entitlement received through that process

3. Two Main Types of Succession

(A) Testate Succession (With Will)

When a person leaves behind a valid will, property is distributed according to that will.

Key features:

- Person can choose beneficiaries

- Person can decide shares

- Will must be legally valid and properly executed

(B) Intestate Succession (Without Will)

When a person dies without a valid will, property is distributed according to statutory rules.

4. India’s Personal Law System

India does not follow a single uniform inheritance law. Instead, succession depends largely on the religion of the deceased, unless the person married under civil law.

Broadly:

- Hindus, Buddhists, Jains, Sikhs → Hindu Succession Act, 1956

- Muslims → Muslim Personal Law (Shariat)

- Christians, Parsis, Jews, and civil marriages → Indian Succession Act, 1925

5. Hindu Succession Law (Overview)

5.1 Testate Succession

- A Hindu can dispose of self-acquired and ancestral property by will.

- Almost complete freedom of disposition.

5.2 Intestate Succession

Heirs are classified into categories.

Class I Heirs (Highest Priority)

- Son

- Daughter

- Widow

- Mother

- Children of predeceased son or daughter

All Class I heirs inherit equally.

Class II Heirs

If no Class I heirs exist, property goes to Class II heirs in a specified order (father, siblings, etc.).

5.3 Ancestral Property and Coparcenary

- Sons and daughters become coparceners by birth.

- Each has an equal share.

- A coparcener may dispose of their share by will.

5.4 Women’s Property Rights

A Hindu woman is the absolute owner of property she acquires and can freely sell, gift, or will it.

6. Muslim Succession Law (Overview)

Muslim inheritance is based on fixed fractional shares.

6.1 Testate Succession

- A Muslim can bequeath only up to one-third of property by will.

- More than one-third requires consent of heirs.

6.2 Intestate Succession

Heirs fall into:

- Sharers (fixed shares)

- Residuaries (take remainder)

- Distant kindred

General principle:

- Son receives double the share of a daughter.

7. Christian, Parsi, and Civil Law Succession

Governed by Indian Succession Act, 1925.

If spouse and children exist:

- Spouse → one-third

- Children → two-thirds equally

If only the spouse exists:

- Spouse inherits everything.

If no spouse or children:

- Parents and then other relatives inherit.

8. What Property Passes by Succession

- Houses, land, flats

- Bank accounts

- Investments

- Business interests

- Jewellery and valuables

9. Property That Does NOT Pass by Succession

Certain assets pass directly to nominees or surviving owners:

- Life insurance with nominee

- Provident fund / pension with nominee

- Jointly owned property with survivorship clause

However, nomination does not always mean ownership. Legal heirs may still claim beneficial ownership.

10. Wills: Legal Essentials

A valid will must:

- Be made voluntarily

- Be made by a person of sound mind

- Be signed by testator

- Be attested by two witnesses

Registration is optional but advisable.

11. Probate and Letters of Administration

Probate

Court certificate confirming validity of will.

Letters of Administration

Issued when there is no will or no executor.

Probate is compulsory in certain cities for specific communities.

12. Rights of Legal Heirs

Legal heirs have the right to:

- Receive their lawful share

- Demand partition

- Challenge illegal transfers

- Contest fraudulent wills

13. Partition of Property

Partition can be:

- By mutual agreement (family settlement)

- By registered deed

- Through a court decree

Partition ends joint ownership.

14. Disinheritance

- Under Hindu and Christian law, a person can generally disinherit heirs by will.

- Under Muslim law, complete disinheritance is not permitted.

15. Taxation of Inherited Property

- No inheritance tax in India

- Income earned from inherited property is taxable

- Capital gains tax applies to the sale

16. Succession Certificates

Required for transferring debts and securities, such as:

- Bank deposits

- Shares

- Bonds

Issued by the civil court.

17. Digital Assets and Succession

Includes:

- Email accounts

- Cryptocurrency

- Cloud storage

- Online businesses

Best practice: mention access instructions in will.

18. Advanced Concepts

18.1 Doctrine of Representation

Grandchildren inherit the share their deceased parent would have received.

18.2 Per Stirpes vs Per Capita

- Per stirpes → branch-wise distribution

- Per capita → equal among individuals

18.3 Family Settlement Deeds

Courts encourage amicable family settlements to avoid litigation.

19. Common Succession Disputes

- Forged wills

- Undue influence

- Exclusion of heirs

- Benami property claims

- Boundary and title issues

20. Practical Estate Planning Tips

- Make a clear will

- Update it regularly

- Nominate beneficiaries correctly

- Maintain asset inventory

- Consult legal professional

21. Why Succession Planning Matters

Proper planning:

- Prevents family disputes

- Saves time and money

- Protects vulnerable dependents

- Ensures wishes are respected

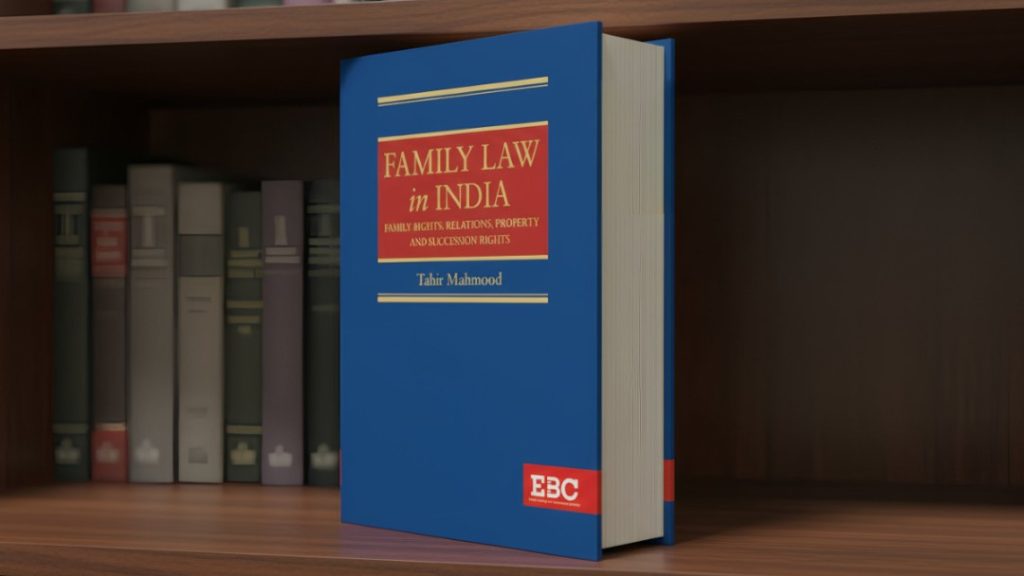

To gain more knowledge on this subject, you may refer to this book.