Investing in financial markets can be rewarding but also risky. To safeguard investors and ensure market integrity, India relies on the Securities and Exchange Board of India (SEBI). Since its inception in 1992, SEBI has been pivotal in regulating securities markets and protecting investor interests. This blog explores its role, legal framework, and practical implications for both law students and investors.

The Securities and Exchange Board of India (SEBI) is the regulatory authority for India’s securities markets. Established under the SEBI Act, 1992, its primary mandate is to protect investor interests, promote fair practices, and develop efficient capital markets. SEBI’s creation was a response to frequent market manipulation and frauds in the 1980s, ensuring that investors could participate in markets with confidence and transparency.

Legal Framework Governing SEBI

SEBI’s functions and powers are primarily derived from:

- The Securities and Exchange Board of India Act, 1992 – The foundational statute that empowers SEBI to regulate, supervise, and penalize market participants.

- Securities Contracts (Regulation) Act, 1956 (SCRA) – Governs trading of securities on stock exchanges.

- Depositories Act, 1996 – Provides legal recognition to depositories and electronic holding of securities.

- Companies Act, 2013 – Mandates disclosure requirements and corporate governance standards relevant to listed companies.

- Listing Obligations and Disclosure Requirements (LODR) Regulations, 2015 – Ensures transparency in public companies and protects investors from misinformation.

These laws collectively give SEBI the authority to regulate, investigate, and enforce compliance in India’s capital markets.

Investor Protection: SEBI’s Core Role

SEBI protects investors through prevention, regulation, and redressal mechanisms. Its functions can be categorized as follows:

1. Regulation of Market Intermediaries

- SEBI monitors brokers, sub-brokers, investment advisers, and mutual funds.

- It ensures proper registration, adherence to codes of conduct, and financial soundness.

- Violations can attract penalties, suspension, or cancellation of licenses.

2. Disclosure and Transparency

- Companies must disclose financial statements, material events, and corporate governance details.

- Transparency reduces information asymmetry, enabling investors to make informed decisions.

3. Prevention of Market Manipulation

- SEBI prohibits insider trading, price rigging, and fraudulent practices under the SEBI (Prohibition of Insider Trading) Regulations, 2015.

- Regular surveillance ensures fair and efficient markets.

4. Investor Education

- SEBI conducts seminars, workshops, and awareness campaigns.

- Initiatives like “SCORES” allow investors to lodge complaints online against companies or intermediaries.

5. Enforcement and Penalties

- SEBI can investigate violations, freeze assets, and initiate prosecution in courts.

- For example, SEBI v. Sahara India demonstrated SEBI’s power to protect investors from fraudulent investment schemes.

SEBI’s Tools for Investor Protection

- Regulatory Guidelines: SEBI issues comprehensive rules for mutual funds, IPOs, stock brokers, and credit rating agencies.

- Investor Grievance Mechanism: Through SCORES, SEBI tracks complaints and ensures resolution.

- Monitoring and Surveillance: SEBI monitors trading patterns and intervenes to prevent market abuse.

- Investor Education Programs: Conducted nationwide, targeting retail and first-time investors.

By combining regulation, education, and enforcement, SEBI minimizes risks and fosters trust in the market.

Practical Implications for Investors and Law Students

For Investors:

- Provides a safe environment to invest in stocks, mutual funds, and corporate bonds.

- Ensures redressal of complaints related to mis-selling, fraud, or unfair practices.

- Enhances confidence by enforcing disclosure norms and monitoring corporate behavior.

For Law Students:

- Understanding SEBI’s role helps in corporate law, securities law, and financial regulation studies.

- Case studies like Sahara, NSE co-location scam, and Insider Trading cases are crucial for learning enforcement mechanisms.

- Knowledge of SEBI regulations prepares students for legal practice in capital markets and compliance roles.

SEBI plays a pivotal role in safeguarding investors, ensuring transparency, and regulating India’s capital markets.

Through its regulatory, educational, and enforcement initiatives, SEBI fosters a fair and trustworthy investment ecosystem.

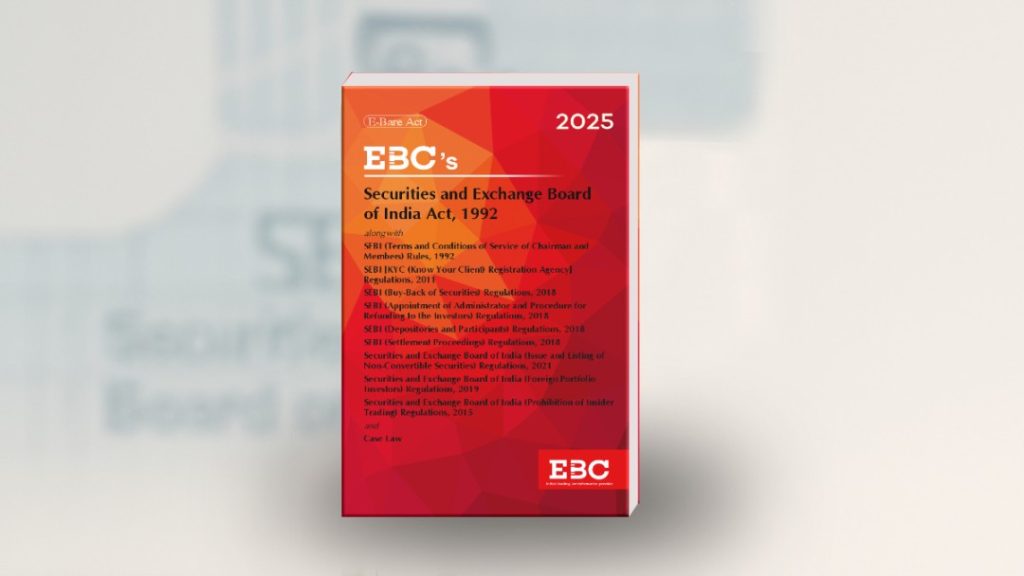

For both investors and law students, understanding SEBI is crucial to navigate the securities market confidently. To deepen your understanding, explore this valuable resource.