In everyday transactions, cheques serve as a convenient method of payment. However, when a cheque bounces meaning it is returned unpaid by the bank it can lead to serious legal consequences. Understanding the reasons behind a bounced cheque the legal framework governing such incidents and the steps to take can help individuals navigate this situation effectively.

What Does ‘Cheque Bounce’ Mean?

A cheque bounces when the bank refuses to honor it. This refusal can occur for several reasons including

- Insufficient Funds The account holder’s balance is lower than the cheque amount

- Expired Cheque The cheque is presented after its validity period typically three months

- Signature Mismatch The signature on the cheque does not match the bank’s records

- Technical Errors Issues like overwriting or unclear writing on the cheque

When a cheque is dishonored the bank issues a Cheque Return Memo to the payee indicating the reason for the dishonor.

Legal Framework: Negotiable Instruments Act 1881

In India the legal consequences of a bounced cheque are primarily governed by Section 138 of the Negotiable Instruments Act 1881. This section criminalizes the dishonor of a cheque issued for the discharge of a legally enforceable debt or liability.

Key Provisions of Section 138

- Dishonor Due to Insufficient Funds If a cheque is returned unpaid due to insufficient funds or if the account is closed

- Issuance of Legal Notice The payee must send a legal notice to the drawer within 30 days of receiving the return memo demanding payment within 15 days

- Filing a Complaint If the drawer fails to make payment within the stipulated time the payee can file a criminal complaint within 30 days of the notice period’s expiry

Penalties for Offense

Upon conviction the drawer may face

- Imprisonment Up to 2 years

- Fine Up to twice the amount of the cheque

- Both Imprisonment and Fine In certain cases both penalties may apply

Steps to Take When a Cheque Bounces

If you find yourself in a situation where your cheque has bounced consider the following steps

- Obtain the Return Memo Collect the Cheque Return Memo from your bank which provides the reason for dishonor

- Send a Legal Notice Within 30 days of receiving the return memo send a legal notice to the drawer demanding payment within 15 days

- Wait for Payment If the drawer fails to pay within the stipulated time you can proceed with legal action

- File a Complaint File a criminal complaint under Section 138 of the Negotiable Instruments Act in the appropriate Magistrate Court within 30 days of the notice period’s expiry

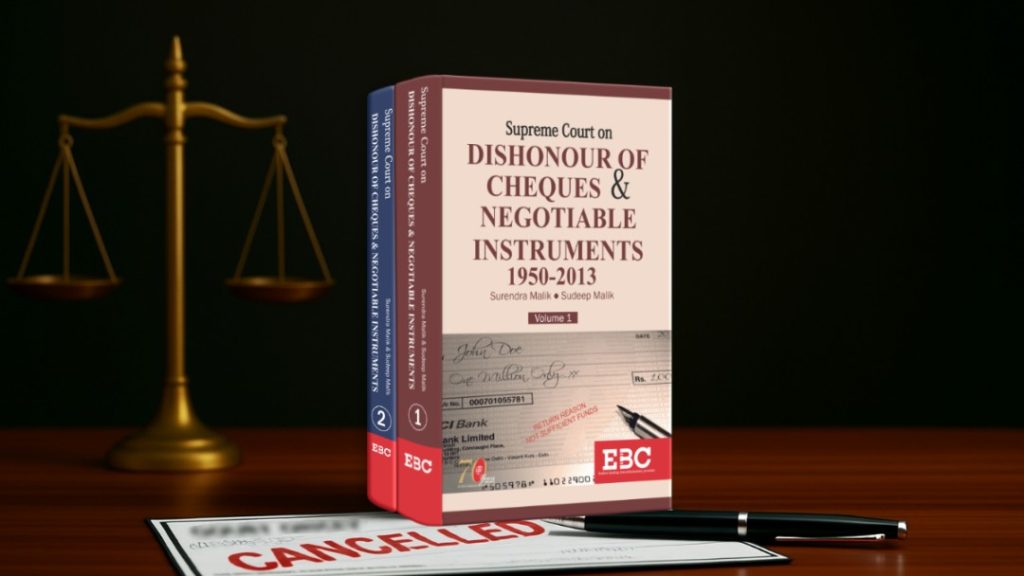

For an in-depth understanding of cheque dishonor and related legal principles consider reading:

Supreme Court on Dishonour of Cheques and Negotiable Instruments , This book here, offers a comprehensive analysis of key Supreme Court judgments on cheque dishonor and negotiable instruments, making it an invaluable resource for legal practitioners and anyone interested in this subject.

Cheque bounce is a serious offense in India with legal implications under Section 138 of the Negotiable Instruments Act 1881. Understanding the reasons behind a bounced cheque the legal processes involved and the steps to take can help individuals protect their rights and navigate such situations effectively. Always ensure that cheques are issued with sufficient funds and within the validity period to avoid legal complications.